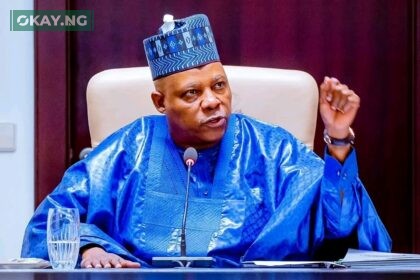

The revenue mobilization of Nigeria and the Niger Republic can be improved if the revenue authorities of both countries work together to deepen their relationship, share tax information and engage in mutual administrative assistance, Muhammad Nami, Executive Chairman of the Federal Inland Revenue Service (FIRS) has stated.

Mr. Nami stated this while receiving his Niger Republic counterpart, the Director-General of the Niger Tax Authority, Mallam Ousmane Mahamane and his delegation at the Headquarters of the FIRS, during a cooperation visit to the Service yesterday.

Recognizing the long-standing relationship and shared culture and languages of the two countries, Muhammad Nami noted that it was important for the FIRS to work with the Niger Tax Authority given the “presence of high-net-worth Nigerian individuals and companies trading in Niger with significant tax implications, which is of great interest to the FIRS.”

The FIRS Executive Chairman also highlighted the working relationship enjoyed by the Service and the Niger Tax Authority in the past particularly on the community rule on double taxation and transfer pricing.

He stated that there was the need for further cooperation in the areas of sharing of tax information and mutual administrative assistance, especially in the face of increase in trans-border tax within the context of ECOWAS and AFCFTA.

Muhammad Nami used the occasion to share with his Niger Republic counterpart some of the success stories achieved by the FIRS and the contributors responsible for these milestones.

“We have focused on non-oil tax collection and indirect taxes, particularly VAT as well as on the deployment of technology for the automation of FIRS’ processes and procedures for effective tax administration and greater revenue yield, including e-stamping, e-registration, e-filing, e-payment, e-receipt, e-Tax Clearance Certificates, automation of Stamp Duty and VAT, the deployment of VATrac—an automated VAT filing and collection system in the wholesale and retail sectors—and the deployment of a home-grown, integrated tax administration system, the TaxPro Max.

“One of the contributing factors to our improved revenue is the taxation of the digital economy through the implementation of relevant policies, legislations and administrative processes for the collection of taxes (both income taxes and VAT) from the digital economy. This ensures that Nigeria is able to collect taxes on non-resident companies that derive income from the Nigerian market, without physical presence. This further ensures tax equity for local businesses,” he stated.

The Executive Chairman FIRS also stated that “the Service has evolved into a data-centric organization, leveraging on data in revenue forecasting, planning, tax policy formulation and driving compliance and enforcement.”

He also added that one of the contributors to the FIRS successes was the exchange of information it had with other tax authorities, both internally and in other countries as well as the FIRS being a customer-focused institution that has put measures in place to make voluntary compliance easier than ever for taxpayers.

Mallam Ousmane Mahamane, the Director-General of the Niger Tax Authority, in his remarks stated that there was the urgent need for international tax cooperation between the two institutions.

He noted that his Tax Authority was seeking a relationship with the FIRS that would cover cross border trade, the oil sector, the telecommunications sector the digitalization of tax procedures, exchange of tax information, assistance with tax audit, separation of administrative procedures, modernization of tax administration and human capacity development.

He commended the FIRS Executive Chairman, Muhammad Nami for his “outstanding performance” in mobilizing over N6.405 trillion in revenue for the Government of Nigeria.