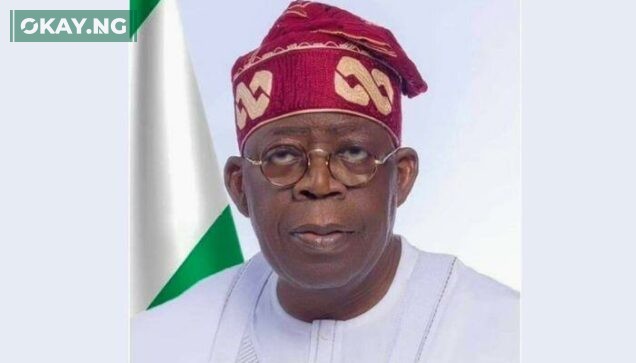

President Bola Tinubu on Tuesday formally submitted three letters to the National Assembly, seeking legislative approval for an ambitious external borrowing plan totaling over $21.5 billion and a domestic bond issuance of ₦757.9 billion to clear outstanding pension liabilities.

The letters, read on the floor of the House of Representatives by Speaker Tajudeen Abbas, outlined a comprehensive borrowing strategy aimed at addressing Nigeria’s critical infrastructure deficits and pension arrears.

In the first letter, Tinubu requested approval to establish a foreign currency-denominated issuance programme in the domestic debt market. The Debt Management Office would implement this, raising up to $2 billion in line with the 2023 Presidential Executive Order on Foreign Currency Denominated Financial Instruments.

The President emphasized that “the proceeds from the bond would be deployed into critical sectors of the economy capable of driving growth, enhancing infrastructure, creating employment, and boosting foreign exchange inflows.” He added that this initiative would deepen Nigeria’s financial markets and strengthen foreign reserves, promoting exchange rate stability.

The total external borrowing plan includes $21.5 billion, €2.2 billion, 15 billion Japanese Yen, and a €65 million grant. Tinubu linked the borrowing necessity to the removal of the fuel subsidy and its economic impact, stating, “In light of the significant infrastructure deficit in the country and the paucity of financial resources needed to address this gap amid declining domestic demand, it has become essential to pursue prudent economic borrowing to close the financial shortfall.”

He assured that the funds would target infrastructure projects across railways, healthcare, and nationwide development programs in all 36 states and the Federal Capital Territory, with goals to “generate employment, promote skill acquisition, foster entrepreneurship, reduce poverty, and enhance food security.”

Acknowledging the debt implications, Tinubu also sought approval for a ₦757.98 billion bond issuance to settle outstanding pension liabilities under the Contributory Pension Scheme. Citing the Pension Reform Act 2014, he noted government struggles to meet pension obligations due to revenue challenges and stressed that settling these liabilities would “alleviate hardship for retirees, restore confidence in the pension system, boost morale among public servants, and stimulate economic growth by increasing liquidity.”

The requests have been referred to relevant House committees for further scrutiny, with the President pledging transparency and accountability throughout the process.