The International Monetary Fund (IMF) has signalled its support for Nigeria’s strategic approach to addressing its immediate financial challenges through carefully managed borrowing. This endorsement came alongside a strong recommendation for the nation to aggressively boost its revenue generation and maintain prudent management of its limited resources.

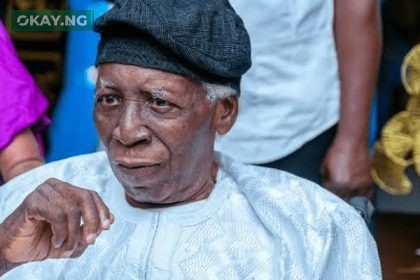

Speaking at a press briefing during the IMF/World Bank Spring Meetings in Washington, D.C., Abebe Aemro Selassie, the IMF’s African Department Director, acknowledged Nigeria’s current economic realities. “There will be a financing need,” Selassie stated, emphasizing the necessity for “a judicious and agile way of dealing with the financing challenges the country faces.”

While underscoring that long-term fiscal health hinges on a robust domestic revenue base, Selassie recognized that borrowing, when executed with caution, plays a vital interim role. “In the long run, the financing gap can only be filled by permanent sources such as revenue mobilisation,” he explained. “But in the interim, carefully looking at all of the options the country has to borrow in a contained way will be part of that solution. And I think the government has been going about this prudently and cautiously so far, we are encouraged by that.”

Selassie commended the Nigerian government’s decisive actions in tackling entrenched macroeconomic distortions, specifically highlighting the removal of fuel subsidies and the ongoing efforts to rectify foreign exchange misalignments. He described these bold steps as “really good to see” and crucial for “restoring macroeconomic balance.”

Furthermore, he noted the ongoing implementation of the third pillar of the IMF-supported reform agenda: the expansion of social protection programs designed to cushion the impact of these reforms on the most vulnerable segments of society. “Expanding social protection, targeting subsidies better, and ensuring that reforms benefit those who need them the most. This has all been very good to see,” Selassie affirmed.

However, the IMF Director stressed that sustained efforts are required, particularly in enhancing transparency within the oil sector. This increased transparency, he argued, is essential to ensure that the fiscal gains from the removal of subsidies are effectively channelled into the national budget. “There’s still a bit more work to do, especially in strengthening transparency in the oil sector so that the removal of subsidies translates into actual fiscal gains,” he noted, adding that recent extensive discussions were held with Nigerian authorities on these critical issues and broader macroeconomic reforms.

Looking ahead, Selassie emphasized the pivotal role of boosting private sector investment and strategically allocating more resources towards vital sectors such as education and infrastructure in Nigeria’s economic transformation. “Nigeria desperately needs more revenue to build more schools, more universities, and more infrastructure,” he asserted. “There’s a comprehensive set of reforms Nigeria can pursue to foster growth and diversify the economy away from dependence on oil.” He pointed out that this diversification is increasingly critical given the recent volatility in global commodity prices.

Turning to the broader regional context, Selassie projected a slowdown in economic growth for Sub-Saharan Africa to 3.8 percent in 2025 and 4.2 percent in 2026, reflecting downward revisions due to “turbulent global conditions, lower external demand, subdued commodity prices, and tighter financial conditions.” He cautioned that the global economic outlook remains “exceptionally high,” with potential escalations in trade tensions or further tightening of financial conditions in advanced economies posing significant risks to the region.

Selassie also highlighted the concerning trend of likely declining official development assistance to Sub-Saharan Africa, which will further strain already vulnerable nations grappling with higher borrowing costs and limited access to financing. “This is constraining their ability to fund essential public services and development projects,” he warned.

While acknowledging the initial easing of inflation across the region, Selassie noted that persistent price pressures in some countries necessitate continued tight monetary policy and fiscal discipline. “These uncertain times demand constant fine-tuning of policy,” he advised. “Governments must strike a delicate balance between driving growth and protecting the vulnerable, while also ensuring macroeconomic stability.”

In conclusion, Selassie underscored the imperative for African nations, including Nigeria, to build robust fiscal and external buffers and maintain credibility and consistency in policymaking to effectively navigate the current complex economic landscape.