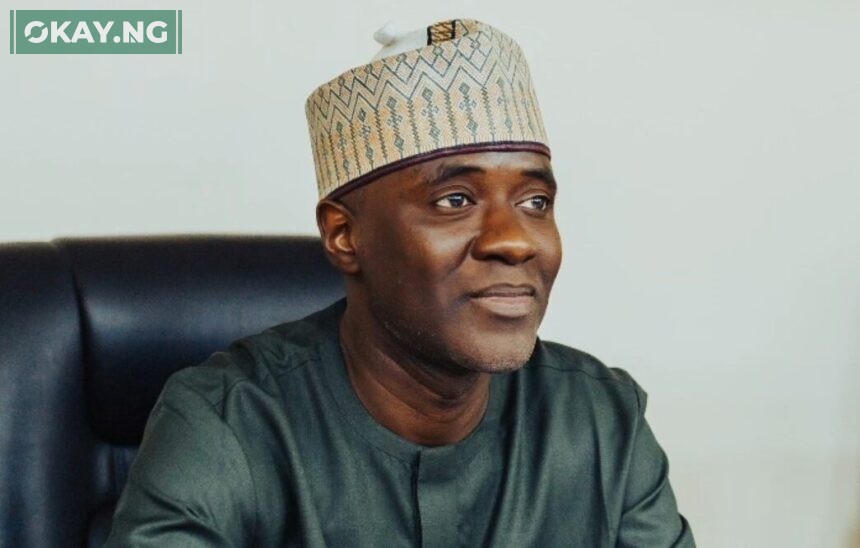

Dr. Aminu Maida, the Executive Vice Chairman and Chief Executive Officer (EVC/CEO) of the Nigeria Communications Commission (NCC), emphasized the critical role of the Financial Technology (FinTech) industry in promoting financial inclusion among underserved communities in Nigeria.

Speaking at the 2023 Nigeria Information Technology Reporters Association (NITRA) FinTech Forum, Dr. Maida lauded the transformative impact of Fintech in revolutionizing the nation’s financial landscape.

The event, themed “Harnessing Nigeria’s Fintech Potential: Challenges and Opportunities,” saw the NCC representative, Mr. Henry Ojiokpota, highlight the sweeping advancements in digital financial services across the country, spurred by the rapid growth of the Fintech sector.

Dr. Maida underscored the substantial influence of Fintech on Nigeria’s financial ecosystem, citing its role as a catalyst for technological advancement, job creation, and economic growth.

He noted that the innovative applications of Fintech, including mobile banking, investment tools, and cryptocurrency platforms, have opened new avenues for business opportunities, particularly among the nation’s youth demographic, which constitutes 70 per cent of the population.

Citing the surge in active mobile subscriptions, which surpassed 220.7 million in August 2023, Dr. Maida highlighted the Fintech industry’s potential to deliver a wide array of financial services to telecom subscribers across the country.

He affirmed the NCC’s commitment to bolstering telecommunications infrastructure to facilitate robust Fintech services and address regulatory challenges, emphasizing the imperative role of digital technologies in extending financial services to marginalized communities.

Dr. Maida emphasized the NCC’s alignment with the Nigerian National Broadband Plan 2020-2025, expressing the Commission’s dedication to achieving the set target of 70 percent broadband penetration by 2025.

He reiterated the NCC’s proactive stance in supporting Fintech policies, enforcing regulations, and fostering collaborations with relevant stakeholders to harness the industry’s vast potential.

Furthermore, he highlighted the NCC’s collaboration with the Central Bank of Nigeria (CBN) to bolster payment systems and promote financial inclusion, in line with the Nigeria Payments System Vision 2025.

Dr. Maida reaffirmed the NCC’s unwavering commitment to maintaining quality of service standards and ensuring uninterrupted connectivity to bolster the sector’s contribution to the nation’s economy.