The Federal Inland Revenue Service (FIRS) has stated that it would use the instrumentality of the Finance Act 2021, through collaboration with taxpayers and key stakeholders to ensure adequate funding of the country’s budget and raise the requisite financing for national development.

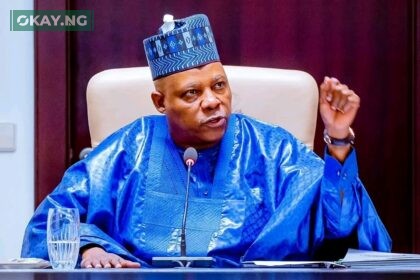

This was stated by the Executive Chairman of the FIRS, Muhammad Nami, yesterday while delivering the keynote address at the KPMG’s Webinar on Nigeria’s 2022 Budget and the Finance Act 2021.

He noted that the Act had provided a framework for equitable treatment, automation and deployment of ICT infrastructure, a single agency for tax collection, taxation of the digital economy among other critical interventions for improved tax administration in the country.

Nami said, “In the past, situations abound where certain goods or services streamed into Nigeria by non-resident companies, especially to consumers, were not subject to VAT. This raised the issue of equity, as goods and services offered by domestic companies are subject to VAT.

“With the amendment of Section 10 of the VAT Act and our publication of the ‘Guidelines on Simplified VAT Compliance Regime for Non-Resident Suppliers’, there is now a mechanism for applying VAT on such goods or services, affording the same tax treatment to both local and foreign supplies.

“Similarly, companies deriving income from Nigeria without physical presence can now be assessed, like other companies with physical presence, on fair and reasonable percentage of their turnover in line with Section 30 of Companies Income Tax Act.”

On automation of tax processes, the FIRS Executive Chairman noted that with the amendment of Section 25 of the FIRS Establishment Act, the Service can now deploy either proprietary or third-party developed technologies for tax administration.

He said, “Those that may still stand in the way of achieving this objective will now be liable to a daily penalty of N25,000.

“With the extension of secrecy and confidentiality requirements to other persons, like service providers, vendors and consultants of the Service, the fear of taxpayers are further allayed on the secrecy and confidentiality of their commercial and other information.”

Nami further noted that with the amendment to Section 68 of the FIRS Establishment Act by the Finance Act, complaints from taxpayers about multiple agencies of government demanding payment of tax from them had been addressed.

“This unfortunate situation is not in line with the national tax policy thrust and was causing confusion for our taxpayers and increasing their cost of compliance.

“However, the amendment to section 68 of the FIRS Act by the Finance Act 2021 has made it clear that FIRS is the only agency responsible for tax assessment, collection and enforcement.

“As such, taxpayers are to expect a streamlined tax administration regime going forward,” he added.

Nami stated that the Service will deploy compliance and enforcement strategies, and will leverage on intelligence and strategic data mining and analysis, to provide intelligence and information to enhance its audit and investigation functions, while also reducing the prevalence of tax abuse in incentive management in the country.