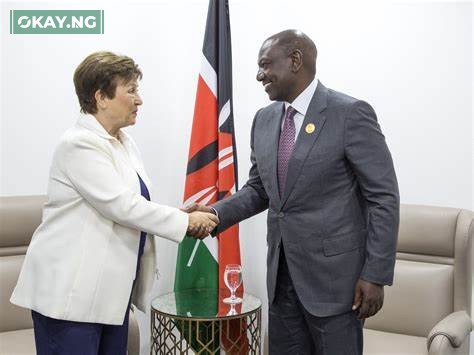

Kenya has initiated discussions with the International Monetary Fund (IMF) for a fresh lending program, a move prompted by the need to incorporate approximately $800 million in unused funds from the previously terminated arrangement. Finance Minister John Mbadi disclosed this development on Monday, following the abrupt conclusion of the ninth and final review of the existing program, which was originally slated to conclude next month.

“Because there is a carryover, there is some money that we have not utilized in the ninth review, then we agreed that there’s a possibility of a funded programme,” Mbadi explained to Reuters, highlighting the core rationale behind the new application. The decision to forgo the concluding review was attributed to time constraints, a factor that ultimately necessitated a revised approach to Kenya’s fiscal strategy.

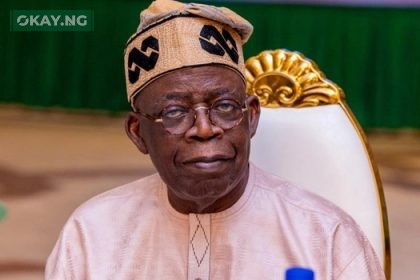

This development arrives at a critical juncture for Kenya, as President William Ruto’s administration grapples with the formidable task of stabilizing the nation’s finances. The preceding period, characterized by extensive borrowing, has resulted in a significant escalation of debt-servicing costs, placing considerable strain on the economy. As a result, the government is actively seeking external financial support to mitigate these pressures and restore fiscal equilibrium.

The implications of this new loan extend beyond mere financial transactions. For many Kenyans, the specter of increased national debt evokes anxieties about potential future austerity measures and the impact on essential public services. We all understand that every dollar borrowed must be repaid, and the burden could potentially affect the lives of ordinary citizens. The nation’s economic health, therefore, becomes a matter of personal concern.

The IMF’s involvement is not merely a technical procedure; it reflects the international community’s assessment of Kenya’s economic trajectory. According to IMF reports, many African nations have seen an increase in debt to GDP ratios since the pandemic. A new program will be subject to stringent conditions, potentially requiring Kenya to implement fiscal reforms that could have far-reaching social and economic consequences.

Experts suggest that while external financing can provide a temporary reprieve, long-term economic stability hinges on sustainable fiscal policies and robust domestic revenue mobilization. The government faces the delicate task of balancing immediate financial needs with the imperative of fostering inclusive and sustainable growth.

Often overlooked in economic discourse is the real-world impact of these decisions. Every percentage point increase in interest rates, every adjustment in public spending, translates into tangible changes in the lives of individuals and families. The ongoing dialogue between Kenya and the IMF is not just about numbers; it’s about the future of a nation and the well-being of its people.