Optimism is brewing regarding Nigeria’s economic outlook as an expert projects a potential further dip in the nation’s inflation rate throughout 2025. This projection hinges on a confluence of governmental policies and a gradual strengthening of the macroeconomic environment, offering a glimmer of hope for citizens grappling with rising costs.

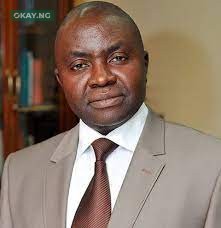

Muda Yusuf, the Chief Executive Officer of the Centre for the Protection of Private Enterprises (CPPE), shared this forecast in a recent discussion with Nairametrics. His analysis points to two key factors underpinning the current moderation in inflation, a trend he anticipates will persist.

“The further deceleration in the inflation rate in February can be ascribed to two factors,” Yusuf explained. The first, he noted, is the statistical “base effect.” This occurs because inflation is measured year-on-year. As Yusuf elaborated, “When we compare the 2025 figures to 2024, you’re likely to see a significant deceleration [in the inflation rate gap]. Inflation is essentially measured on a year-on-year basis, and because prices in 2024 were highly elevated.” This means that comparing current prices to the already high prices of the previous year will naturally show a slower rate of increase.

The second crucial factor, according to Yusuf, is the nascent improvement in macroeconomic stability. “We are beginning to see that the volatility in the exchange rate is beginning to ease,” he observed. This stability in the foreign exchange market is a critical element in controlling inflation, as exchange rate fluctuations significantly impact the cost of imported goods, which in turn affects overall price levels.

Read Also: Nigeria’s Inflation Rate Drops to 23.2% in February Following CPI Rebasing

While this projected decline offers a sense of relief, Dr. Yusuf cautioned against complacency. He emphasised that an inflation rate of 23.18%, even if lower than previous figures, still represents a significant level of price increases. “This trend is likely to continue for the larger part of 2025,” he stated, suggesting a sustained but gradual easing of inflationary pressures.

The implications of a slowing inflation rate are considerable. For many Nigerians, the relentless rise in prices has eroded purchasing power, making everyday essentials increasingly unaffordable.

If Yusuf’s projections hold true, it could translate to a much-needed respite for households struggling to make ends meet. However, the current high rate serves as a stark reminder of the economic challenges that persist and the need for sustained efforts to bring inflation down to more manageable levels. It’s a sentiment I believe many of us share—a cautious optimism tempered by the reality of the economic landscape.