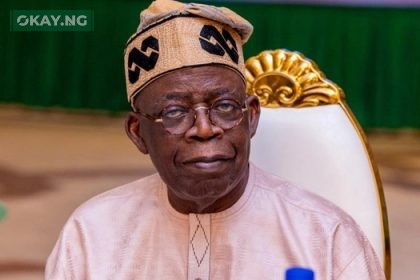

President Bola Tinubu on Thursday officially signed four significant tax reform bills into law, a move he described as a clear indication of Nigeria’s preparedness for modern economic development and increased international investment. According to okay.ng reports, this legislative milestone is expected to bring about a fundamental restructuring of Nigeria’s federal revenue system.

The newly enacted laws designate the Nigeria Revenue Service (NRS) as the exclusive authority for collecting federally chargeable taxes. This change means that prominent revenue-generating bodies such as the Nigeria Customs Service (NCS), the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), and various federal ministries and agencies may relinquish their current tax collection roles. The consolidation aims to unify the tax system and eliminate overlapping responsibilities.

Speaking at the signing ceremony held at the State House in Abuja, President Tinubu stated, “We have opened the door for new economic and business opportunities. We are showing that Nigeria is truly ready and open for business. Easy in, easy out.” He acknowledged the challenges inherent in implementing tax reforms but commended the stakeholders for their leadership and courage throughout the process. “What you have provided is leadership and courage in the face of mounting dispute. Nowhere in the world will tax reforms be any easier,” he added.

The President emphasized that this legislative action marks a pivotal shift in Nigeria’s fiscal policy framework. “We are in transit. We have changed the rule. We have changed some of the misgivings. The question of our tax-to-GDP and all other formulas will be obsolete,” he explained.

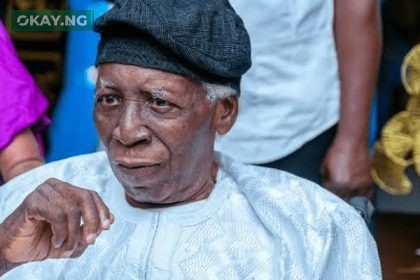

This development follows nearly two years of preparatory work, beginning with President Tinubu’s approval on July 7, 2023, of a Presidential Committee on Fiscal Policy and Tax Reforms. The committee was chaired by Mr. Taiwo Oyedele, a Fiscal Policy Partner and Africa Tax Leader at PriceWaterhouseCoopers. The committee’s mandate was to overhaul tax laws, harmonize tax structures, and improve revenue administration.

After extensive consultations and legislative deliberations, the National Assembly passed harmonized versions of the bills by May 2025, despite initial resistance from some lawmakers and state governors concerned about revenue-sharing implications. The bills include the Nigeria Tax Bill (Fair Taxation), Nigeria Tax Administration Bill, Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill.

President Tinubu highlighted the expected benefits of the reforms: “They will unify our fragmented tax system, eliminate wasteful duplications, cut red tape, restore investor confidence, and entrench transparency and coordination at every level.” He also noted that the previous tax system disproportionately burdened vulnerable populations while fostering inefficiency.

The Executive Chairman of the National Revenue Service, Zacch Adedeji, announced that the reforms will take effect on January 1, 2026, allowing six months for planning and sensitization. “Based on best practices globally… the effective date will be January 1, 2026, by the special grace of Almighty God,” he said.

Taiwo Oyedele described the new laws as “pro-poor,” emphasizing tax exemptions for over a third of workers and small businesses. He also pointed out that essential goods and services such as food, education, healthcare, transportation, accommodation, and housing will be exempt from VAT, providing relief to ordinary Nigerians.

On Channels Television’s Politics Today programme, Oyedele explained that the reforms will foster transparency and efficiency by digitizing tax collection and integrating data such as National Identity Numbers to reduce tax evasion. He outlined three core objectives: people-centric policies, efficiency-driven reforms, and growth-focused strategies.

Senator Sani Musa, Chairman of the Senate Committee on Finance, praised the broad consultations that shaped the laws and emphasized that the reforms consider the less privileged. Hon. James Faleke, Chairman of the House Committee on Finance, lauded the national cooperation that made the reforms possible.

The Nigeria Employers’ Consultative Association (NECA) welcomed the signing, describing it as a long-awaited relief from over a decade of multiple taxation challenges. NECA officials stressed that successful implementation will be critical to realizing the reforms’ benefits.

Additionally, the Special Adviser to the President on Energy, Olu Verheijen, noted that the new laws have codified four executive orders designed to stimulate investment in the oil, gas, and clean energy sectors, unlocking over $6 billion in fresh investments.

This comprehensive tax reform marks a significant step in Nigeria’s economic evolution, aiming to create a streamlined, equitable, and transparent tax system that supports sustainable growth.